FAQ

In this FAQ (Frequently Asked Questions) you can find answers to your questions. If not, please contact us.

To make a national payment (credit transfer) in Switzerland in CHF, please open the “optional settings” window and enter CHF in the “Currency” field. The “Service Level” field must be blank.

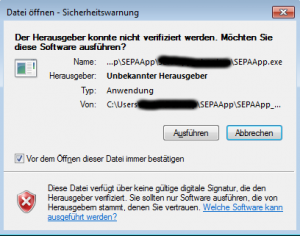

On the new Mac with the M1 and M2 chipsets, MacOS prevents applications not downloaded from the App Store or applications not verified by Apple from running at the BIOS level. You have to give permission in the BIOS.

If the error message is “SEPAApp cannot be opened because the developer cannot be verified.” or “macOS cannot verify that the app does not contain malware.” please follow these instructions: https:// support.apple.com/en-us/guide/mac-help/mh40616/mac

The reason for the error message is that SEPAApp is not listed in the Apple AppStore and therefore SEPAApp cannot be identified as legitimate software by macOS.

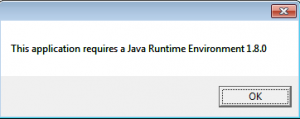

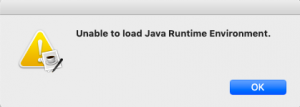

If the error message is the following:

“Exception in thread “main” java.lang.UnsatisfiedLinkError: […] jre1.8.0_202/lib/i386/libawt_xawt.so: libXtst.so.6″

…this only affects the version with Java.

The bundled Java is a 32 bit version, which runs also on 64 bit systems.

But sometimes some 32 bit libraries have to be installed to 64 bit systems with the following command:

“sudo apt-get install libxtst6:i386”

You will receive the e-mails with the license key or invoice in two separate e-mails.

It may happen that these e-mails end up in the spam folder. Please take look at it.

If you still do not find the e-mails, please contact our support: support@sepaapp.eu

If the license key is shown as invalid, it is likely due to a typo. It is best to copy it directly from the e-mail: To avoid typing errors, copy the license no. with Ctrl+C and paste it with Ctrl+V in the text field in SEPAApp. Make sure not to copy any spaces or line breaks.

If the license key has been successfully entered once after installing SEPAApp, the button will be grayed out after restarting SEPAApp and it is not necessary to re-enter the key at any time.

If the key entering was unsuccessful or the key has not yet been entered, make sure that you enter the standard license using the “Enter license” button and – if available – the pro license using the “Enter pro license” button .

You can easily transfer your SEPAApp license key to another computer, if you make sure, that the license key is not used on a second computer at the same time. That means, for example, the complete removal of SEPAApp on your old computer, if you want to enter the license key on a new computer.